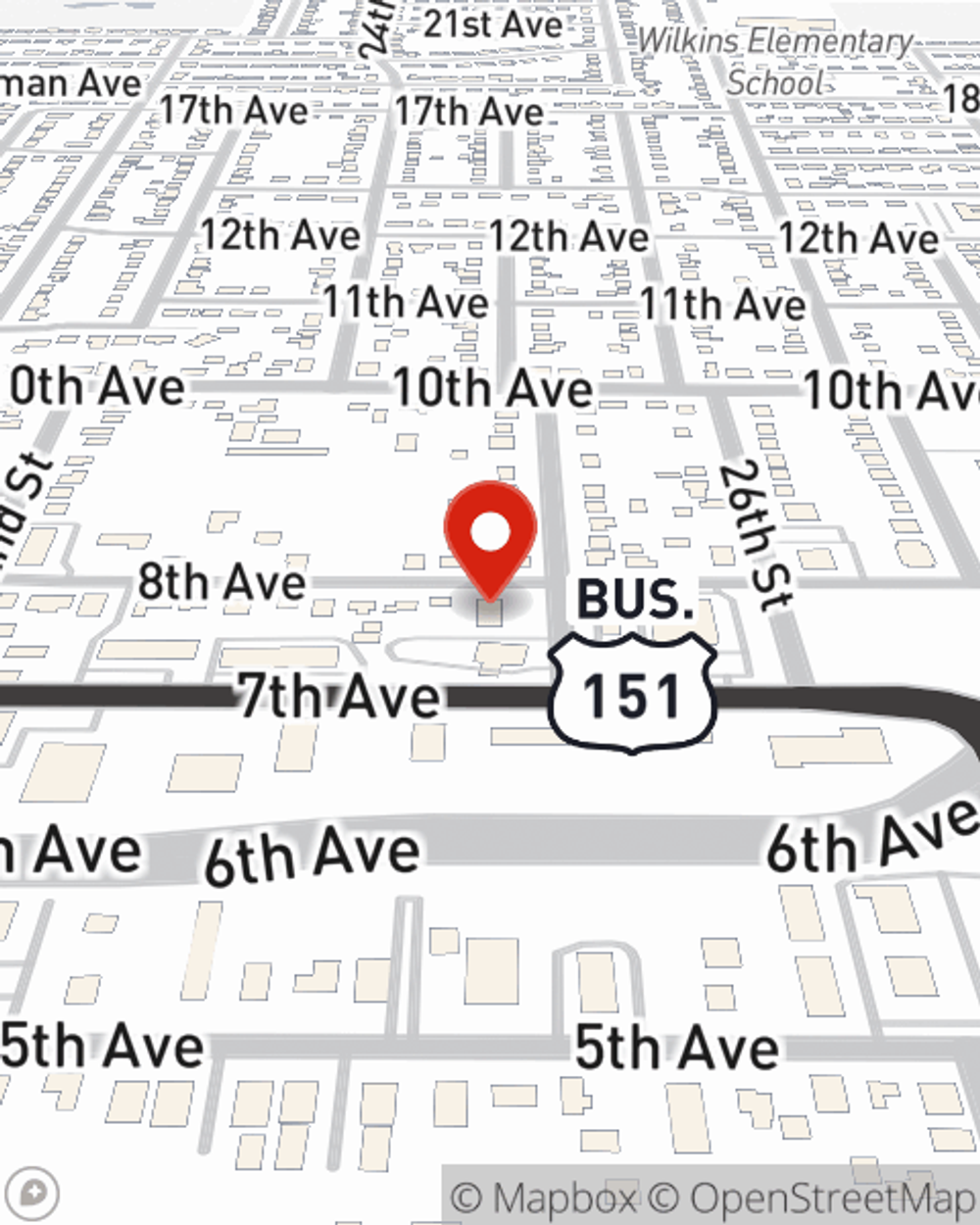

Condo Insurance in and around Marion

Welcome, condo unitowners of Marion

Cover your home, wisely

- Anamosa

- Central City

- Robins

- Marion

- Cedar Rapids

- Center Point

- Urbana

- Hiawatha

- Benton County

- Johnson County

- Linn County

- Mount Vernon

- Shellsburg

- Springville

- Atkins

- Fairfax

Home Is Where Your Heart Is

Investing in condo ownership is a big deal. You need to consider neighborhood home layout and more. But once you find the perfect condominium to call home, you also need dependable insurance. Finding the right coverage can help your Marion unit be a sweet place to call home!

Welcome, condo unitowners of Marion

Cover your home, wisely

Protect Your Home Sweet Home

Your home is more than just a roof and four walls. It's a refuge for you and your loved ones, full of your personal items with both sentimental and monetary value. It’s all the memories attached to every room. Doing what you can to help keep it safe just makes sense! That's why one of the most sensible steps is getting a Condominium Unitowners policy from State Farm. This protection helps cover many home-related mishaps. For example, what if a fire damages your unit or a fallen tree smashes your garage? Despite the aggravation or disappointment from the experience, you'll at least have some comfort knowing your State Farm Condominium Unitowners policy that may help. You can work with Agent Michelle Havener who can help you file a claim to help assist repurchasing your lost items. Preparing doesn’t stop troubles from landing on your doorstep. Coverage from State Farm can help get your condo back to its sweet spot.

If you're ready to bundle or find out more about State Farm's excellent condo insurance, get in touch with agent Michelle Havener today!

Have More Questions About Condo Unitowners Insurance?

Call Michelle at (319) 373-6730 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Michelle Havener

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.